Farmers are increasingly being encouraged to diversify into new areas in order to generate additional income, be it through tourism, green energy or alternative livestock. Stories of successful ventures abound in the media, and the message to farmers seems to be that they should expect to adapt and diversify if they want to survive. But if diversification is really the future of farming, what does this mean for farmers?

Diverse by name, diverse by nature

Farm Business Survey (FBS) figures for 2015/16 indicate that 62% of farms in England have diversified in some way, action that the report describes as a “rational response” to the changing position of agriculture in the UK economy. Of course, in many ways, farms have long been diverse businesses, making the most of their produce through craft or processing – producing cheese from milk or making knitwear from sheep’s wool. As diversification has become an increasingly important source of income, however, farmers have cast their nets wider in search of new revenue streams.

Possible avenues for modern farm diversification are, well, diverse. More obvious options could entail some form of rural tourism or hospitality, for example, developing old barns into holiday lets, opening up fields for camping or setting up on-site shops or cafes. But diversification is much broader and more complex than this. Farmers may branch into less traditional livestock markets, such as alpacas, rabbits or even worms. Diversification could also include generating green energy or growing non-food crops, such as those used for fuel or industrial fibres. The relative importance of these sources of income varies geographically and between sectors, as does the potential of such activities – a farm that is extremely isolated is unlikely to attract passing trade for a shop or café, for example.

Broadening horizons

Andy Gage is a self-confessed entrepreneur. Ever since he inherited his grandfather’s pig and arable farm in Suffolk at the age of 19, he’s been looking for ways to expand the business and generate more income. He has branched into some strikingly diverse areas, from running a livery yard to indoor fish farming, rearing ducks for a food supplier and, his most recent venture, making and selling steel fireballs (spherical fire pits) – which proved to be a smash hit at the Chelsea Flower Show in 2014. But by no means has it all been plain sailing for his undertakings. After his tilapia farm business collapsed in 2007, with losses of £150,000, he embarked on a Nuffield-funded research trip to South Africa and Australia to explore what makes a successful diversification project. His resulting report on diversification strategies sets out guidelines for farmers who are thinking of branching into new initiatives.

Andy cautions that farmers should be wary of jumping on a bandwagon when selecting a suitable enterprise. “I think if you’re a farmer, you need to pick your diversification based on your skill set. If you don’t like people, you can’t do a people-related business,” he says. “Everyone talks about added value, but you’ve got to pick your diversification. A few years ago it was worm farming; then it was truffles, but no one ever made any money on it. It was the same with my fish. That was the big talk in the aquafarming industry. People said, ‘When that’s cracked you’ll get rich.’”

Andy says that his own failures have led him to realise the need to concentrate on his core enterprises, and he urges farmers to secure their primary business before seeking to broaden their horizons. “It is easier to sell new products to your existing customers than it is to sell new products to new customers,” he says. “Diversification is not the answer to a poorly performing business.”

The core business

Diversification activities can generate significant additional income: they were worth £580 million in total in 2015/16, according to the Farm Business Survey (FBS) figures. But, as with any business venture, they require time, staff and inevitably new expertise. This means they have the potential to take farmers’ attention away from the day-to-day running of the farm and undermine the core business of agricultural production.

Tom Lifely runs a medium-sized arable farm in Herefordshire. Over the years he has tried a number of diversification activities, including a golf driving range and a number of renewable energy initiatives, with varying degrees of success. He describes how his projects in solar and biomass energy have been largely hassle-free and beneficial; however, the farm’s recently installed combined heat and power (CHP) machines – hailed as the next big thing in green energy – have proved costly and time-consuming to manage. “This project straight from the off has been fraught with difficulties and frustrations,” says Tom. “Firstly, the machines take a serious amount of man hours looking after, at all hours of night and day. This has gotten to the extent that two of us are spending so many hours with them that the rest of the farm is suffering.” “On a more positive note,” says Tom, “we have another small enterprise consisting of fishing lakes with log cabins on them. This has proved to be fantastic over the last few years and we are consistently fully booked throughout the season.”

Rachel Lawrence of Rural Business Research, the team that put together the FBS, points out that many diversification activities are intrinsically linked and complementary to, rather than at odds with, farming. “For a lot of these businesses the farming activity is crucial to the diversification activity,” says Rachel. “Maybe you’re a dairy farm and you’re selling cheese, and selling cheese could be your biggest source of income, but without having the farming side of things, you’re not going to be selling cheese. Equally, if you have tourists coming to stay, a lot of the time they’re staying because they want to be staying on a farm in the countryside.”

These activities can therefore be seen not as replacing or overshadowing the core business, but as a way of adding stability. As Andy points out in his Nuffield report, “The multi-layered business can survive many more hardships than an enterprise reliant on a single income stream.”

Diversify or die?

With Brexit looming and a huge question mark hanging over future British agricultural policy, UK farmers are bracing themselves for more hardships over the next two years. This is contributing to the pressure on farmers to diversify, as they seek to introduce reliable sources of income that will continue yielding profit when EU subsidies – currently by far the largest source of non-agricultural income for farmers – cease.

John Welbank is a rural regeneration specialist with the development consultants Rural Futures. Though he sees diversification as offering great business opportunities, he’s pragmatic about the reasons that so many farmers feel they need to branch out. “The figures speak for themselves in terms of the business value of diversification,” he says. “What that probably indicates is that there’s an awful lot of agricultural businesses out there that aren’t agriculturally viable, so they have had to look at other alternatives.”

“I was forced into it,” says Andy, who agrees that he had little choice but to diversify. “I took over the family farm and there just wasn’t the income on the farm to support me and staff,” he says. “If you’re a large farm, you can probably afford to specialise. You can probably focus and you’ll make a living, but if you’re a small farmer I don’t think you have a choice. For me personally, though, I’m an entrepreneur. I would do it anyway; I love it.”

John recognises that diversification won’t suit every farm or every farmer. “There’s never a ‘one size fits all’,” he says. “But,” he points out, “there are so many different opportunities out there. It will come down to your own ability to change. If you’re willing to look at change and you’re willing to change in some way then you can look at diversification as a benefit to the wider business.”

Tom believes he has had to diversify just to keep the business afloat, but he welcomes the opportunities that new projects offer. “I think it’s definitely a necessity nowadays, unless you are farming on a massive scale,” he says. “There is definitely pressure to keep money flowing through the business. Personally, I see it as offering exciting new opportunities, and I think my father definitely does also. However, the more we have taken on, the less attention the arable side of things has had. We have brought in all these extra enterprises, but the issue at the moment is none of them are at a level where we can bring extra staff in to manage them.”

Tom points here to a key problem with these diversification projects: they don’t necessarily bring in enough revenue to cover the extra labour they require. The FBS figures show that for 4% of farms, their diversification activities actually lost money; and even for those that generated significant income, there is always the question of whether this has been at the cost of the farm’s core agricultural production. As John of Rural Futures notes: “Like with any business, you’ve only got so much time and so many staff and so much competence in certain areas.”

When diversifying, then, farmers need to consider how they can ensure their new activities will be self-sustaining. “That is the goal really for me,” says Tom. “Once something can stand on its own, it’s time to start looking at the next project.”

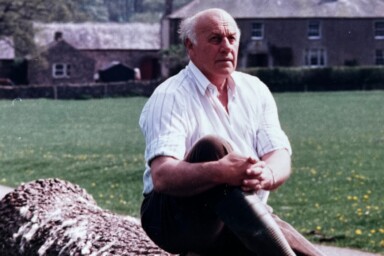

Photograph: Michael Mees